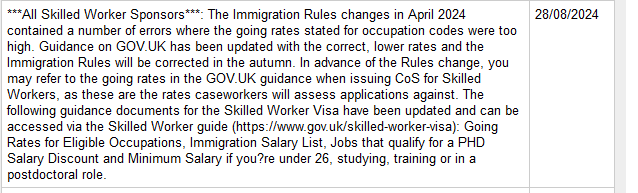

The House Workplace has confirmed through a notification on the sponsorship administration system that some wage going charges included in March 2024 statement of changes to the immigration rules HC 590 have been incorrectly acknowledged and that sponsors ought to as a substitute consult with guidance up to date on 10 July 2024 when issuing certificates of sponsorship underneath the expert employee route.

Background

The adjustments to the immigration guidelines, which got here into impact on 4 April 2024, considerably reformed the expert employee route by rising the overall wage threshold from £26,200 to £38,700 and by updating occupation code going charges from the 25th percentile to the median, primarily based on up to date pay knowledge from the Workplace for Nationwide Statistics.

These adjustments aimed to cut back internet migration to the UK as fewer roles would qualify underneath the expert employee route. Nevertheless, there are transitional provisions for people granted permission as a talented employee underneath the foundations in place earlier than 4 April 2024 and who’ve held steady permission as a talented employee since. For these people a decrease common wage threshold of £29,000 applies, in addition to a decrease going charge primarily based on the 25th percentile for his or her occupation code.

Occupation codes that are eligible for the expert employee route and their respective going charges are listed in Appendix Skilled Occupations of the immigration guidelines:

- Table 1 incorporates the occupation codes and going charges for people topic to the usual common wage threshold and median going charges (i.e. these making use of underneath factors choices A – E);

- Tables 2 and 2a include the occupation codes and going charges for people topic to the decrease common wage threshold and 25th percentile going charges (i.e. these making use of underneath factors choices F – J), with Desk 2a permitting people sponsored underneath occupation codes which are not eligible underneath the route to use to increase their visas underneath this code solely have been they proceed in employment with the identical sponsor; and

- Tables 3, 4 and 5 relate to people making use of underneath factors possibility Okay in a listed well being or schooling occupation.

Sponsors are due to this fact required to make sure that a job meets the upper of the related common wage threshold or going charge (primarily based on a 37.5-hour week) previous to assigning a certificates of sponsorship to a person, which has traditionally meant having regard to the going charge as acknowledged in Appendix Expert Occupations.

Owing to the erroneously acknowledged going charges within the present model of the foundations, sponsors ought to as a substitute use the charges within the steering, with the House Workplace confirming that caseworkers will assess functions in opposition to these charges versus these contained within the Appendix.

Impacted occupation codes

By evaluating the going charges acknowledged within the Appendix and the steering we have now recognized the next occupation codes as having discrepancies.

In relation to the usual going charge:

- 1163 Senior officers in fireplace, ambulance, jail and associated companies;

- 1253 Hairdressing and sweetness salon managers and proprietors;

- 1257 Rent companies managers and proprietors;

- 2112 Organic scientists;

- 2462 Probation officers;

- 2464 Youth work professionals;

- 3411 Artists;

- 3413 Actors, entertainers and presenters;

- 3429 Design occupations not elsewhere labeled;

- 3512 Ship and hovercraft officers;

- 5232 Car physique builders and repairers;

- 5243 Television, video and audio servicers and repairers;

- 5314 Roofers, roof tilers and slaters; and

- 8232 Marine and waterways transport operatives.

In relation to the decrease going charge:

- 1134 Buying managers and administrators;

- 1135 Charitable organisation managers and administrators;

- 1162 Senior cops;

- 1163 Senior officers in fireplace, ambulance, jail and associated companies;

- 1212 Managers and proprietors in forestry, fishing and associated companies;

- 1253 Hairdressing and sweetness salon managers and proprietors;

- 1257 Rent companies managers and proprietors;

- 2112 Organic scientists;

- 2141 Internet design professionals;

- 2142 Graphic and multimedia designers;

- 2317 Lecturers of English as a international language;

- 2435 Skilled/chartered firm secretaries;

- 2471 Librarians;

- 3224 Counsellors;

- 3314 Jail service officers (under principal officer);

- 3411 Artists;

- 3413 Actors, entertainers and presenters;

- 3422 Clothes, trend and equipment designers;

- 3429 Design occupations not elsewhere labeled;

- 3531 Brokers;

- 3572 Careers advisers and vocational steering specialists;

- 4113 Officers of non-governmental organisations;

- 5212 Steel plate employees, smiths, moulders and associated occupations;

- 5221 Steel machining setters and setter-operators;

- 5232 Car physique builders and repairers;

- 5235 Boat and ship builders and repairers;

- 5243 Television, video and audio servicers and repairers;

- 5245 Safety system installers and repairers;

- 5314 Roofers, roof tilers and slaters;

- 5423 Print ending and binding employees; and

- 8232 Marine and waterways transport operatives.

Conclusion

The incorrectly acknowledged going charges within the Appendix could have given sponsors the impression that sure people didn’t meet the necessities of the expert employee route after they in reality did. Sponsors ought to have regard to the corrected going charges contained within the steering till the immigration guidelines are corrected in autumn.